#038 — A Few Details Once You Pay Off Your Car Loan

As I recently chronicled, we recently paid off my wife’s car. The bank mailed the title to us the other day, and reminded us we have a few details left to take care of now that we’re official car owners. I’m passing along their reminders with a few of my own suggestions & comments mixed in. For other inspiration, see a similar article written by PT Money when he paid off his car in January.

What To Do After You Pay Off Your Car Loan

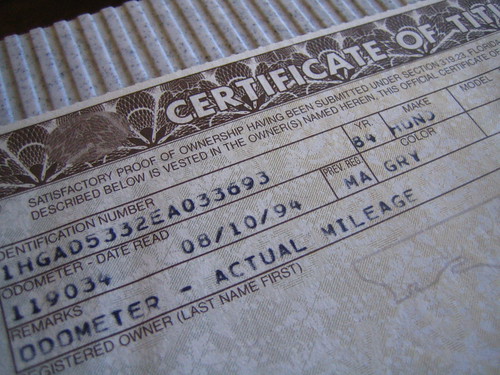

The Title

Check your title to make sure a bank representative signed & dated your release of lien. They should have upon mailing it to you, but hey, mistakes happen. A signed & dated release of lien is satisfactory to transfer a clean title down the road, but if you want the lien completely removed from your title, go to your local county tax office, pay the applicable fees, and order a new title with the lien removed.

Store your title in a safe place. Title can be stolen and forged, so I recommend you don’t keep the title in your car. Leave it in a protected place, such as your home safe, a locked file cabinet, or a safe deposit box at your local bank.

Insurance Policy

Change the “loss payee” on your insurance policy. When your vehicle’s financed, the lender requires you list them as “loss payee”, which means that if you total your car, any insurance payment for a total loss goes to cover the remaining loan balance first. When you become the outright owner, you should change this to avoid any miscommunication and hassle with the bank and insurance adjuster should you total your car. We use Esurance for our auto insurance, so this was easy for us. I just logged onto my online account, and edited the car information. In fact, I had forgotten to do this for our other car, so I changed them both on the spot.

While you’re at it, review the rest of your insurance policy. I considered raising my deductible, but decided against it for now. But I did decide to add roadside assistance to our policy should our cars breakdown. Both our vehicles are getting along in miles and we have an 80 mile round-trip commute each day. I figured an extra $10 every six months wasn’t too bad for roadside assistance coverage.

Personal Finance

Snowball your car payment. If you just paid off a typical car loan, odds are your payment was about $400/month. What will you do with all this extra money each month? Don’t waste it on frivolous spending. Be focused & intentional with that extra dough. Add it to your debt snowball, or continue paying yourself a car payment each month, so you can buy your next car with cash, rather than a cash advance.

Take a minute to celebrate! That’s one less chain in the bondage of debt. One more link broken on your way to freedom. Congratulations are in order! Pat yourself on the back, enjoy a celebratory dinner — whatever works to keep you motivated to continue on the path to financial awareness.

photo by rick

photo by rick

Most Recent Comments