#016 — The MyMoneyMinute Stimulus Plan (Part 2)

The M$M Economic Stimulus Plan

This is Part 2 of 2 in this series. Click on this sentence to read Part 1, which covers what fundamental principles should be a part of any government stimulus plan.

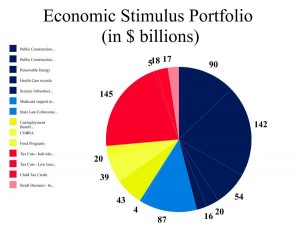

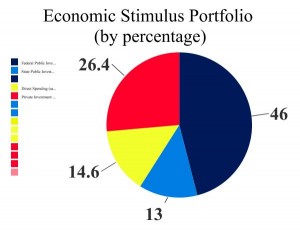

Yesterday, President Obama signed the $787 billion economic stimulus into law. I think it misses the mark and violates in many respects the fundamentals of spending taxpayer money to stimulate the economy. My alternative proposals are below; all proposals must satisfy Fundamental #1 by being targeted, specific action to seek a particular goal.

1. Incentives

Following the guidelines of Fundamental #3, it must be government economic policy must encourage good personal financial behavior. Therefore, instead of direct stimulus checks, I propose stimulus matching funds be used on home down payments, pre-paid tuition, and health savings account deductibles (HSAs).

The best type of government stimulant is one that provides it’s citizens incentive to save up and pay for their shelter, education, and health care.

Real Estate. For the sake of simplicity, I’ll propose that for every dollar you save for a down payment up to 10% of purchase price, the government will match your down payment. This could also be a graduated, tiered incentive (save 10%/match 5%, save 20%/match 10%, etc.). It can also be capped at a specific dollar amount (match up to $25,000), or the cap can vary by market depending on cost of living. Other stipulations:

- No credit cards, cash advances, or 401(k)/403(b) withdrawals will receive matching funds — it MUST be cash earned & saved. You will not be able to rob Peter to pay Paul and expect government to support your behavior. Do it on your own dime.

- No 80/20s, ARMs, interest-only, or HELOCs allowed. If you want the matching funds, it must be a 30-year or less mortgage with a fixed interest rate.

Point is, you stimulate the downtrodden real estate market, and most importantly, the benefits go to those that have been fiscally sound and did not overbuy during this last real estate bubble.

- They were the victors because they DID pay their bills and WERE responsible with their finances, while most of us were not.

- Allow the victors in our economic crisis be the ones to bring us out of the recession.

- Reward their good behavior & provide incentives to the rest of us to copy it so we don’t end up down this path again.

Education. If there’s one area that’s exploded over the last decade, it’s college tuition. The burden of student loans has grown exponentially since the early 1990s. The education cartel increases in power with each new academic year. If anyone knows the burden and risk it is yours truly. Unfortunately, I have more student loan debt than anyone I know, but I also have a plan to get rid of it faster than anyone I know!

- I propose matching funds for pre-paid tuition to any accredited institution of higher education.

- Reward parents with 529s, and reward students that are working while putting themselves through school.

- Again, no credit cards, cash advancements, or 401(k)/403(b) withdrawals will be matched.

Health Care. Medical bills are the leading cause of bankruptcy, and a drain on our economy. Health Savings Accounts are becoming vastly popular, because it can be obtained outside the employment environment at a decent cost. I propose matching funds for deductibles on HSAs.

- Provides incentives to save money for when emergencies happen.

- Reduces the amount of bankruptcies caused by medical bills.

- Provides incentives toward the HSA and away from COBRA & the employment-based health care model.

2. Direct Investment

In compliance with Fundamental #2, direct government investment should have long-term benefits. My answer is to (a) build and improve infrastructure & (b) invest in our children’s future.

Infrastructure. If we’re going to spend hundreds of billions of dollars on a stimulus, do it with specifically-targeted projects that will provide long-term benefits, that get people working immediately.

- Fix bridges, overpasses, and roads.

- Build & expand light rail systems. I know here in the Dallas-Fort Worth metroplex, our light rail network could be extended into the suburbs to ease traffic congestion. This would be money well-spent, because it is near-term jobs with long-term benefits.

Children’s Future. Each child that is born in the U.S. receives a one-time $2,500 investment into a personal retirement account at birth.

- 4 million children are born in the United States annually = $10 billion investment/year.

- Unlike 401(k)/403(b), no withdrawal allowed for any reason until person reaches retirement age (65).

- An 8% annual growth rate = $445,000 retirement account for each citizen at age 65.

- Parents allowed to match initial $2,500 investment + $1,000/year into each individual account until age 25.

This promotes both parents & children to save for retirement, and shifts our paradigm to thinking about the future.

3. Tax Cuts

We also need to provide incentives to our businesses and those with entrepreneurial spirit. Ideas & small business are the true backbone of the American economy.

- $10,000 tax write-off to businesses for each new employee hired in 2009 (net gain). The amount of a cut can vary, but this will encourage those who are on the fence about hiring another worker to go ahead and hire someone.

- Provide tax breaks or government-initiated loans for wind farms to implement aspects of the Pickens’ Plan to reduce our dependency on foreign oil.

NOW IT’S YOUR TURN. THOUGHTS/SUGGESTIONS? ADDITIONS/DELETIONS??

LEAVE A COMMENT BELOW!!

photo by abraaten

photo by Elsie esq.

Most Recent Comments