Tax Refunds: Does Size Matter?

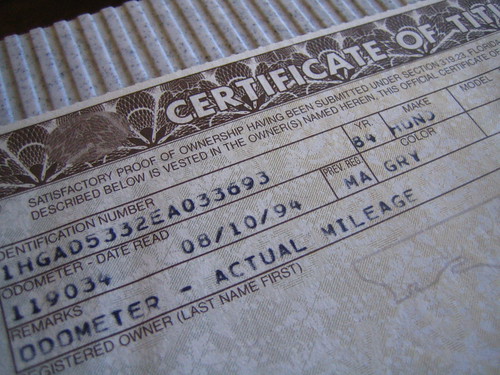

Taxes have been filed, and a refund has arrived in the MyMoneyMinute household to the tune of about $360. Last year, we were hit with about a $2,000 tax bill, so I was pleasantly surprised to end up on the receiving side this time around… but should I be?

Money Experts: “You Don’t Want A Big Refund!”

Many financial experts, including Dave Ramsey, frown upon a big tax refund. Why? Because the money you’re getting back was yours in the first place — it’s just been held hostage by the government for a year, interest free! The solution for them is to adjust your income tax withholding on your paycheck so that you receive more money each pay period. Additionally, if you receive a larger lump-sum return, you’re more likely to spend it on a big-ticket item (electronics, vacation, etc.) rather than use it in a more financially responsible way, like paying off a car loan or credit cards, building up an emergency fund, or even for extra giving to your local church ministries.

For more on this argument, read articles by these two great bloggers:

Craig Ford from Bible Money Matters – 3 Reasons Why A Big Income Tax Refund Is A Horrible Thing.

Jason Price from One Money Design — Income Tax Refund: Is It Good Or Bad?

Me: “It’s Not So Cut & Dry”

In an ideal world, I agree with the guys above. Unfortunately we don’t live in an ideal world. If I lived in an ideal world, I’d never owe taxes or get a refund. Then again, I also would never have charged money on a credit card, financed my life (cars, furniture, a home, and an education that cost even more than the home!). Oh, and I’d have a stable job, an ideal salary, with predictable raises and bonuses too.

The 2 Major Reasons To Tolerate A Big Tax Refund

While aspiring for the ideal scenario above, there are reasons a big tax refund isn’t such a horrible thing after all. Here are a few of them:

1. You Suck With Money

Let’s face it. If, instead of getting a big chunk of money in a refund each year, you got monthly slices of it by altering your withholding, it is almost guaranteed that money would be spent, and you wouldn’t even know where it went. A few extra bucks each paycheck would be swallowed up by a restaurant here and a Starbucks trip there. When you get one big check after tax season each year, you only have to make one financial choice each year, not 12 monthly choices to do the financially smart thing. And hey, even if you make the wrong choice and blow the entire refund, at least you’ll get a really cool big-ticket item out of the deal, rather than spending it all throughout the year and not knowing where it went. If you’re gonna be stupid with your money, at least get a TV or an all-inclusive vacation to show for it.

The majority of us are financially undisciplined. Until you get disciplined, a big refund can protect you from… you. For a great analogy of this argument, check out an article written by Sam at Financial Samurai — Tax Refunds Are Good For Most People, Because Most People Can’t Save.

2. The Danger of “Normal”: Risk Is Diminished

What my blogging friends didn’t discuss in this tax debate was this: we face problems adjusting our income withholdings because life is rarely “normal” or “ideal”. Most people I know with a “stable” salary and tax structure are government employees. In this economic climate, even those jobs aren’t safe. People are underemployed and laid off in record numbers to the point where it is difficult to determine what your expected yearly withholdings should be. Additionally, life happens too — you get married, buy a house, have children, buy a different house, someone gets injured on the job or gets pregnant — all these life changes affect your taxes, which means your withholdings may be off again.

For me, a limited return is ideal, but does not factor in the reality of risk. From a risk standpoint, I’d much rather risk (1) giving the government my money interest-free for a year and get a big refund, rather than (2) miscalculate my withholdings and having to scramble to come up with an unexpected tax bill.

Conclusion

Currently, my life is just not stable enough to justify the risk of accidentally under-withholding to the point where I owe a big tax bill, and I suspect most people are in the same boat. Perhaps down the road, life is a bit more stable and less in flux, I can spend the extra energy to get my withholdings down to a science. But until then, I’ll err on the side of caution.

What Say You?

Don’t forget to read the articles by Craig, Jason, and Sam – then drop a comment below and let me know how you deal with your income withholding & tax refunds.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=dd96d915-2c79-4636-9447-e9a0aacc7b9a)

Most Recent Comments