#007 — How Would You Invest the Economic Stimulus Portfolio?

U.S. House Passes One-Sided Economic Stimulus Bill

Yesterday, the House Democrats passed an $819 billion Economic Stimulus Bill. Despite lobbying by President Obama for bi-partisanship & House Democrat leaders insistence on following party line, no Republicans joined in support of the bill, while 11 Democrats voiced opposition to their party’s wishes. The final vote on H.R. 1 was 244-188. A parallel bill is now in the Senate, which is expected to increase the size of the stimulus bill, which will already be the biggest federal expenditure in history upon passage. In the 10-year plan, nearly two-thirds of the stimulus money will be injected within the first 18 months.

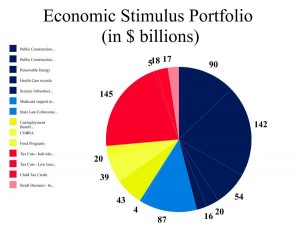

Highlights of the bill include:

- $90 billion for construction projects (roads & infrastructure)

- $142 billion to rebuild public schools (no money given to private schools)

- $54 billion for renewable energy

- Boost Medicaid & state law enforcement — $91 billion

- Extend unemployment benefits, and increase COBRA, WIC, and school lunch programs — $102 billion

- Tax cuts of $500/$1,000 per year for individuals/couples (capped at incomes exceeding $75k single/$150k couple); total cost $145 billion

- Increase to $250k the amount a small business can write off; estimated up to $17 billion savings

Okay, I’ve got to admit — I’m a political junkie. It runs in my veins, and even when I’m not politically active, my political brain is always running on the back-burner. First off, I have had a tough time digesting the rate at which our congress has spent money. Increased revenues & the War on Terror notwithstanding, we have spent way to much over the last decade.

How Would YOU Diversify This Portfolio?

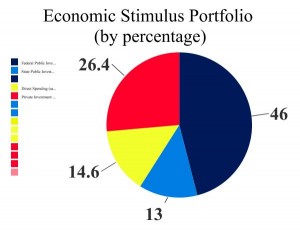

Currently, here’s how the House’s Stimulus Bill portfolio is diversified. Click on each respective picture to enlarge:

Balancing Act

If a stimulus package is needed, government should use our money to create an environment where dependency is not further created on the government for more public jobs. Rather, more of the stimulus money should be invested in private businesses, which can regenerate the money and use the free market to grow and expand upon ideas and serving their clientele. Government construction projects seem like a one-time fix; yet another patch job on a huge problem.

While it is good to invest in public works and extend support to those currently feeling the economy’s effects, perhaps this stimulus bill needs to properly diversified between direct spending (safety net programs), public investment (federal & state spending), and private investment (individual & business tax policy).

Nearly 60% is projected to be invested on federal & state public works (not long-term jobs), 14.6% on safety net programs, and 26% spent on private-sector investments. Just as if I were analyzing an investment portfolio, I would say too many eggs are in one basket, and that this stimulus bill needs to be re-balanced a bit.

How about you? Would you “re-balance” the Economic Stimulus Bill?

Most Recent Comments